Your Life Your Wealth

A Media Production of Cordasco Financial Network

Now Celebrating 400+ Episodes

Subscribe To The Your Life Your Wealth Podcast Enter Your Email Address Below

How Your Core Values Impact Your Financial Plan # 440

April 25, 2024

Financial planning is about more than just numbers. It may be reflective of the values and priorities you hold dear. Today, John Walker, Regional Vice President, Mercer Advisors, discusses ways to help identify your guiding principles. He also discusses the financial benefits you, and your loved ones, may receive when you apply those principles.

Listen Here

A Spring Cleaning Guide for your Finances # 439

April 18, 2024

Spring cleaning our home or office is common for many of us, but have you considered spring cleaning for your finances? John Walker, Regional Vice President, Mercer Advisors, discusses why now may be the perfect time of year to clean up your financial plan, investments, debt and savings. Are all in line with your current needs and priorities?

Listen Here

Life and Wealth: The Unbreakable Link # 438

April 11, 2024

The very essence of this weekly podcast is about the inevitable intersection of Life and Wealth. Today, John Walker, Regional Vice President, Mercer Advisors, discusses how your personal finances and your lifestyle are intertwined. He talks about the need to assess, and sometimes reassess, your priorities as you plan for retirement. Will you have the financial capability to enjoy your retired years as you imagined?

Listen Here

Your 401k: Take It, Leave It, or Roll it into an IRA # 437

April 4, 2024

When you leave your employer, you have several options in dealing with your 401k. Today, John Walker, Regional Vice President, Mercer Advisors, is joined by his Mercer Advisors’ colleague Dennis Jablonoski, Certified Retirement Plan Specialist. They discuss several effective ways to deploy your existing retirement plan dollars when you leave an employer.

Listen Here

Will You Escape the Dreaded IRS Audit # 436

March 28, 2024

There have been reports that the IRS has strengthened its enforcement efforts. With this year’s tax filing deadline quickly approaching, John Walker, Regional Vice President, Mercer Advisors, is joined by Mercer Advisors’ Tim Joseph CERTIFIED FINANCIAL PLANNER ™ professional and CPA. They address several frequently asked questions about IRS audits. Plus, Tim shares a few tax filing tips to keep in mind.

Listen Here

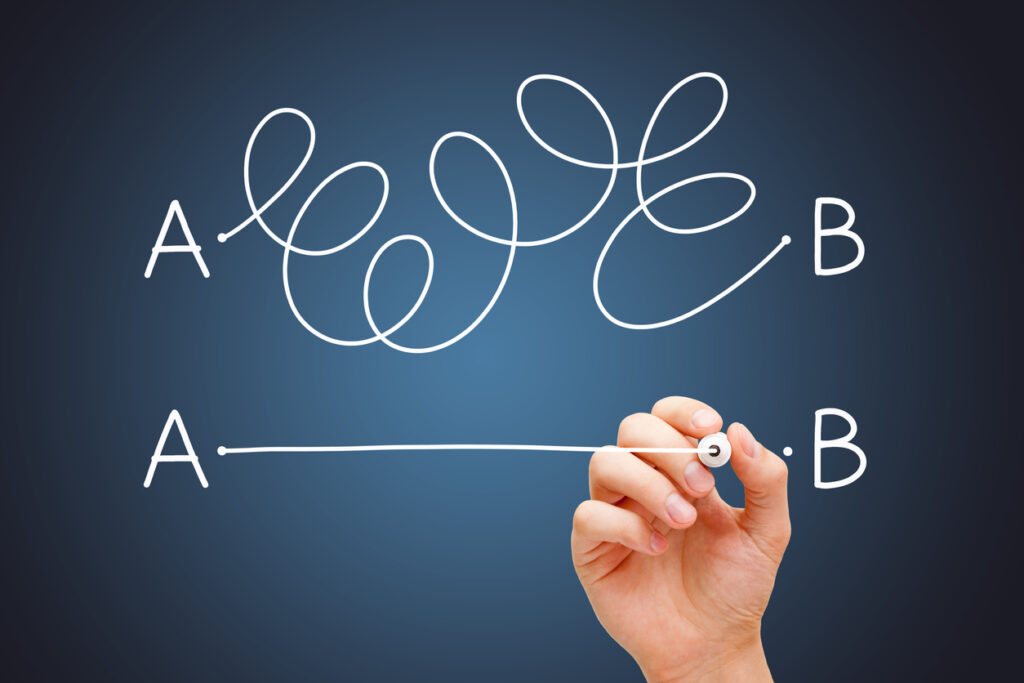

Keeping It Simple: A Strategy for Investing # 435

March 21, 2024

Accomplishing things in a straight-forward and uncomplicated manor has a way of making life easier. Today, John Walker, Regional Vice President, Mercer Advisors, discusses how to apply this philosophy to your financial and retirement planning to help increase your probability of success.

Listen Here

How You Can Better Understand What Drives Your Investment Behaviors # 434

March 14, 2024

Psychologists remind us that our thinking and reasoning is often influenced by our preconceived notions or ideas. Today, John Walker, Regional Vice President, Mercer Advisors, discusses ways to identify, as well as work with and around, biases we may have relating to money and investing.

Listen Here

Estate Planning: The Reasons Why # 433

March 7, 2024

There are several reasons why you should consider putting your financial affairs in order before you die. Among them, is that estate planning can help clear your own mind and help give your heirs direction in fulfilling your wishes in their time of grief. Today, John Walker, Regional Vice President, Mercer Advisors is joined by colleague Ryan Flurer, Financial Planner at Mercer Advisors. They discuss the benefits of proper estate planning.

Listen Here

Your Spirit Animal: What it is and How it Relates to Financial Planning # 432

February 29, 2024

Did you know that you may have a spirit animal when it comes to your finances? Your spirit animal represents you, your personality, and your attitudes toward investing. Having a little fun today, John Walker, Regional Vice President, Mercer Advisors, will help you determine which spirit animal best describes you. This discussion may help you better understand how and why you make your decisions about money.

Listen Here

Optimizing Your Social Security Benefits # 431

February 23, 2024

Maximizing Social Security benefits for you and your spouse can be tricky since there are several different options to consider. Today, John Walker, Regional Vice President, Mercer Advisors, is joined by colleague Ryan Flurer, Financial Planner at Mercer Advisors. They discuss Social Security for individuals and married couples and explore several options to help you get the most from this important cashflow source.

Listen Here Call us at 855-558-3500

Call us at 855-558-3500